Use Cases

Use case 1: Supporting the Informed Decision to go to Trial

-

Client: An MPL non-public Optimalex client

-

Solution: Agatha’s predictive analytics for litigation risk assessment

Challenge:

For complex, high-stakes malpractice claims, the decision to settle or proceed to trial can have enormous financial consequences. The company’s leadership team, including its board, is often faced with situations where traditional judgment could benefit from an AI, data-backed, assessment. This is particularly the case when evaluating whether a plaintiff might win or whether the company might get hit with an excess verdict.

Agatha in Action:

The company implemented Agatha’s predictive analytics to support its claims and litigation strategy teams with data-driven insights. Two key features directly inform high-level trial decisions:

-

Indemnity Probability Prediction

For any given case, the platform estimates the probability of a plaintiff verdict, using a combination of jurisdictional data, plaintiff attorney track records, expert witness histories, case narratives, and other contextual factors. This allows decision-makers to understand the likelihood of liability in objective, probabilistic terms with a new level of precision. -

Nuclear or Excess Loss Estimate

Even in cases where a defense verdict is plausible, carriers must consider worst-case outcomes. The system estimates the chance of a verdict exceeding the policy limit, flagging those rare but catastrophic scenarios that justify settlement despite low overall risk. These estimates factor in venue, severity cues, and past nuclear outcomes in similar contexts.

Result:

In a recent high-profile claim, the team chose to take a case to trial, based on a favorable indemnity probability estimate and a low probability for an excess verdict. The estimates helped persuade the board that the company could proceed to trial with a strong defense, rather than pay a high-demand settlement. The jury ultimately returned a defense verdict, avoiding both indemnity and reputational exposure.

Impact:

The predictive system has become a trusted component of board-level decision-making. It helps shift the conversation from “What do we feel about this case?” to “What does the data tell us in this case?” leading to more confident, transparent, and defensible trial strategies.

What Agatha users had to say about it:

“Using the nuclear loss report helped us move our CEO and the chair of the claims committee from granting us settlement authority to granting us trial authority”

“Using similar claims and nuclear loss reports is certainly useful when the defence counsel is close to a 50-50 split”

“The County variable is very helpful as well as we may not have a ton of experience in each venue”

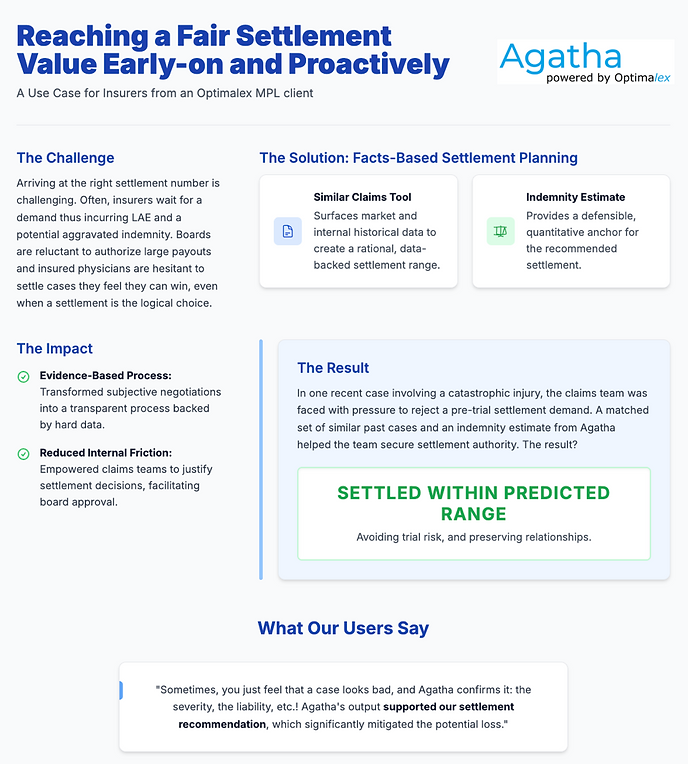

Use case 2: Reaching a fair settlement value early-on and proactively

-

Client: An MPL Optimalex client

-

Solution: Agatha’s predictive analytics for claim valuation and strategy

Challenge:

Arriving at the right settlement number is challenging. Often, insurers wait for a demand thus incurring LAE and a potential aggravated indemnity. Boards are reluctant to authorize large payouts and insured physicians are hesitant to settle cases they feel they can win, even

when a settlement is the logical choice.

The Solution: Facts-Based Settlement Planning

To address these challenges, the insurer deployed Agatha’s predictive analytics to support early, proactive, facts-based settlement planning. Two features are central to the process:

-

Similar Claims

The platform surfaces a curated set of prior claims that closely resemble the current case accounting for fact patterns, injuries, jurisdiction, plaintiffs, and defense dynamics. These precedents allow the claims team to demonstrate that the proposed settlement falls within a rational, data-backed range and is consistent with past outcomes. -

Nuclear or Excess Loss Estimate

Based on historical data, both market and internal data, and advanced predictive algorithms,the system provides an indemnity range that accounts for venue, injury severity, allegation,demographics, plaintiff/defense counsel patterns, and historical jury behavior. This estimate becomes a defensible anchor for the recommended settlement number, offering a quantitative benchmark to guide negotiations and internal approvals.

Result:

In one recent case involving a catastrophic injury, the claims team was faced with pressure to reject a pre-trial settlement demand. A matched set of similar past cases and an indemnity estimate from Agatha helped the team secure settlement authority. The case was settled within the predicted range, avoiding trial risk and preserving relationships.

Impact:

The platform empowers claims professionals with the data needed to justify difficult settlement decisions. It transforms what used to be a subjective negotiation into a transparent, evidence-based process, facilitating internal agreements, protecting the insured, and preserving relationships.

What Agatha users had to say about it:

“Sometimes, you just feel that a case looks bad, and Agatha confirms it: the severity, the liability, etc.! Agatha's output supported our settlement recommendation, which significantly mitigated the potential loss."

Use case 3: Optimizing Outside Counsel Performance and Legal Spend

-

Client: A nationwide and specialized general liability carrier

-

Solution: Agatha’s performance analytics for legal vendor management

Challenge:

For a carrier managing thousands of litigated premises liability claims, from slip-and-falls in restaurants to incidents at retail stores, the cost of outside legal defense is a massive expenditure. The challenge is that assigning these cases to panel counsel is often guided by historical relationships and reputation rather than objective data.

Without a systematic way to measure performance, carriers don't truly know which law firms are the most effective or efficient for a given type of case. As a result, high-stakes claims may be sent to expensive, high-billing firms that aren't delivering superior results, leading to inflated legal fees, unnecessarily long claim cycles, and inconsistent settlement outcomes.

The Solution: Data-Driven Counsel Management

To overcome this, the carrier deployed Agatha’s performance analytics to build a data-driven vendor management program. The platform ingests and analyzes data on all litigated files, providing an objective view of which law firms deliver the best results. Two features are key to this process:

-

Counsel Performance Audit: Upon starting the programme, Agatha benchmarks every law firm on the carrier's panel across similar case types. It provides a clear scorecard tracking key metrics like average legal spend per case, claim cycle time, motion success rates, and final indemnity paid versus the initial reserve and case estimates. This replaces anecdotal evidence with hard data.

-

Complexity-Based Assignment Engine: Alongside the audit, Agatha analyzes the complexity of each new litigated claim, based on information available at FNOL. The system then recommends the best-suited firm from the panel, matching the claim's specific risk factors to the firm with the proven track record of handling similar cases most effectively and efficiently.

-

Continuous panel improvement: By providing ongoing performance data, Agatha allows the carrier to manage its panel counsel like an investment portfolio. High-performing firms are rewarded with more business, while underperformers are identified for coaching or removal, ensuring the entire panel's quality improves over time.

Result

A new high-exposure lawsuit was filed after a patron suffered a significant injury at a restaurant insured by the carrier. In the carrier's previous workflow, this case would have been automatically assigned to "Big Law LLP", their long-standing, premium-billing defense firm. However, a review of Agatha’s Counsel Performance Audit revealed a surprising insight.

The data showed that for high-value premises liability claims, "Big Law LLP" had a 25% longer average cycle time and settled for 15% more than a smaller, specialized boutique firm on their panel. Alerted by this data, the claims executive assigned the new case to the more efficient boutique firm. Armed with a data-backed strategy, the firm resolved the case six months faster compared to the benchmark and for a value much closer to Agatha’s initial forecast, saving the carrier over $150,000 in combined indemnity and legal expenses on a single case.

Impact

Agatha adds scientific data-driven insights to the traditional relationship-based art of legal vendor management. It empowers the carrier to treat its panel of counsels as a managed portfolio, rewarding high-performing firms with more business, reducing or terminating business with low-performers, and making objective decisions on case allocation. This strategic approach drives down Loss Adjustment Expense (LAE), reduces indemnity leakage, and fosters stronger partnerships with law firms that deliver superior financial outcomes.

What Agatha users had to say about it:

“We always thought we knew who our best law firms were. Agatha showed us the data. Now, we don't just assign cases; we strategically invest our legal spend with the partners who demonstrably deliver the best results. It has completely changed our approach to managing litigation.”

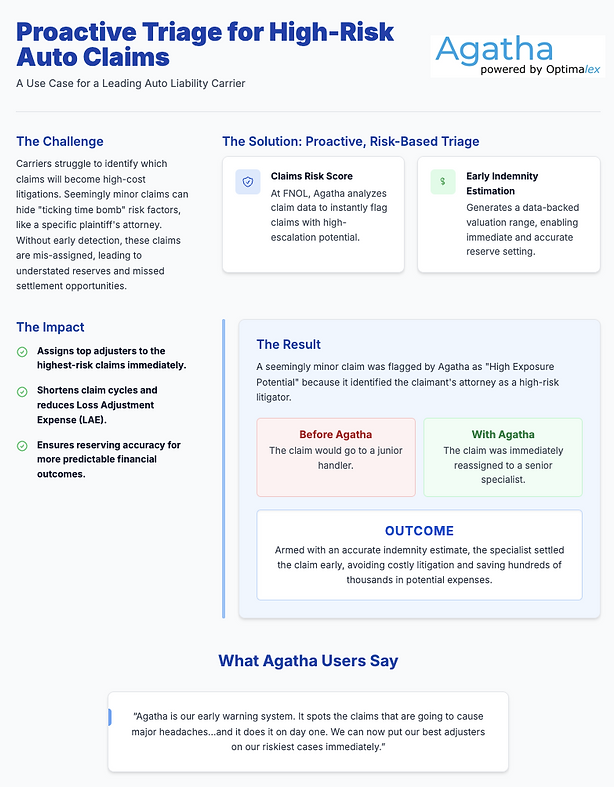

Use case 4: Proactive Triage for High-Risk Auto Claims

-

Client: A leading Auto Liability Carrier

-

Solution: Agatha’s predictive analytics for claim triage and valuation

Challenge:

For a high-volume auto carrier, not all claims are created equal. The challenge lies in identifying the small percentage of claims that will escalate into high-cost, complex litigations. A seemingly minor fender-bender can have hidden risk factors—like the involvement of a specific plaintiff’s attorney or patterns of medical treatment known to inflate costs.

Without a systematic way to spot these indicators at First Notice of Loss (FNOL), these "ticking time bomb" claims are often assigned to a routine workflow. By the time their true potential is realized, reserves are understated, legal costs have mounted, and the window for an efficient, early settlement has closed.

The Solution: Proactive, Risk-Based Triage

To overcome this, the carrier deployed Agatha’s predictive analytics to power an early warning and triage system. The platform analyzes claims from the moment they are reported, enabling a proactive, risk-based response. Two features are key to this process:

-

Optimalex Claims Risk Score Agatha analyzes early data points against historical claim outcomes. It recognizes subtle but critical correlations so that each new claim receives a risk score, immediately flagging those with a high statistical probability of escalating in severity and cost.

-

Early Indemnity Estimation Alongside the risk score, Agatha generates an initial indemnity forecast. Using the limited data available at FNOL, the system provides a data-backed valuation range. This allows the claims team to set more accurate reserves immediately, providing management with a clearer picture of financial exposure.

Result

A recent claim involved a low-speed collision with initial reports of minor soft-tissue injury. In the carrier's previous workflow, this would have been routed to a junior handler. However, Agatha’s FNOL analysis immediately flagged the claim as “High Exposure Potential.”

The system identified that the claimant’s attorney had a documented history of taking similar cases to trial and winning costly verdicts. Alerted by the high-risk score, the claims manager immediately reassigned the file to a senior litigation specialist. Armed with an accurate early indemnity estimate from Agatha, the specialist pursued a proactive resolution strategy and settled the claim for a fair value before litigation could even begin, saving potentially hundreds of thousands in indemnity and legal expenses.

Impact

Agatha transforms claims intake from a reactive queue into a strategic triage center. It empowers the carrier to allocate its most experienced resources to its highest-risk claims immediately. This proactive approach shortens claim cycles, reduces Loss Adjustment Expense (LAE), and ensures reserving accuracy, leading to more predictable financial outcomes across the entire book of business.

What Agatha users had to say about it:

“Agatha is our early warning system. It spots the claims that are going to cause major headaches months down the road, and it does it on day one. We can now put our best adjusters on our riskiest cases immediately, instead of finding out we have a problem a year later.